Kesselrun Prepares for Further Drilling and Provides Update on Brokered Private Placement

Kesselrun Prepares for Further Drilling and Provides Update on Brokered Private Placement

THUNDER BAY, ON, November 26, 2020 – Kesselrun Resources Ltd. (TSXV:KES) (“Kesselrun” or the “Company”) is pleased to provide final results from the initial drill program on the Huronian Gold Project as it prepares for the next phase of drilling. Results reported are from the McKellar and Huronian Zones.

Highlights

- High grade plunging shoot intersected at McKellar assayed 22.6 g/t over 1.0 m within a wider zone of 2.7 g/t over 16.8 m in hole 20HUR025

- Other McKellar intercepts assayed 1.1 g/t over 19.1 m in hole 20HUR020, 1.0 g/t over 21.8 m in hole 20HUR021 and 1.1 g/t over 15.9 m in hole 20HUR023 outlining a wide zone of gold mineralization.

- Huronian Zone drilling shows significant gold mineralization remaining among the historically mined area with hole 20HUR028 intercepting 8.7 g/t over 1.0 m within a wider zone of 0.8 g/t over 13.0 m in the hanging wall of 203S stope (200 foot level) and hole 20HUR029 intercepting 13.0 g/t over 0.9 m above 101S stope (100 foot level).

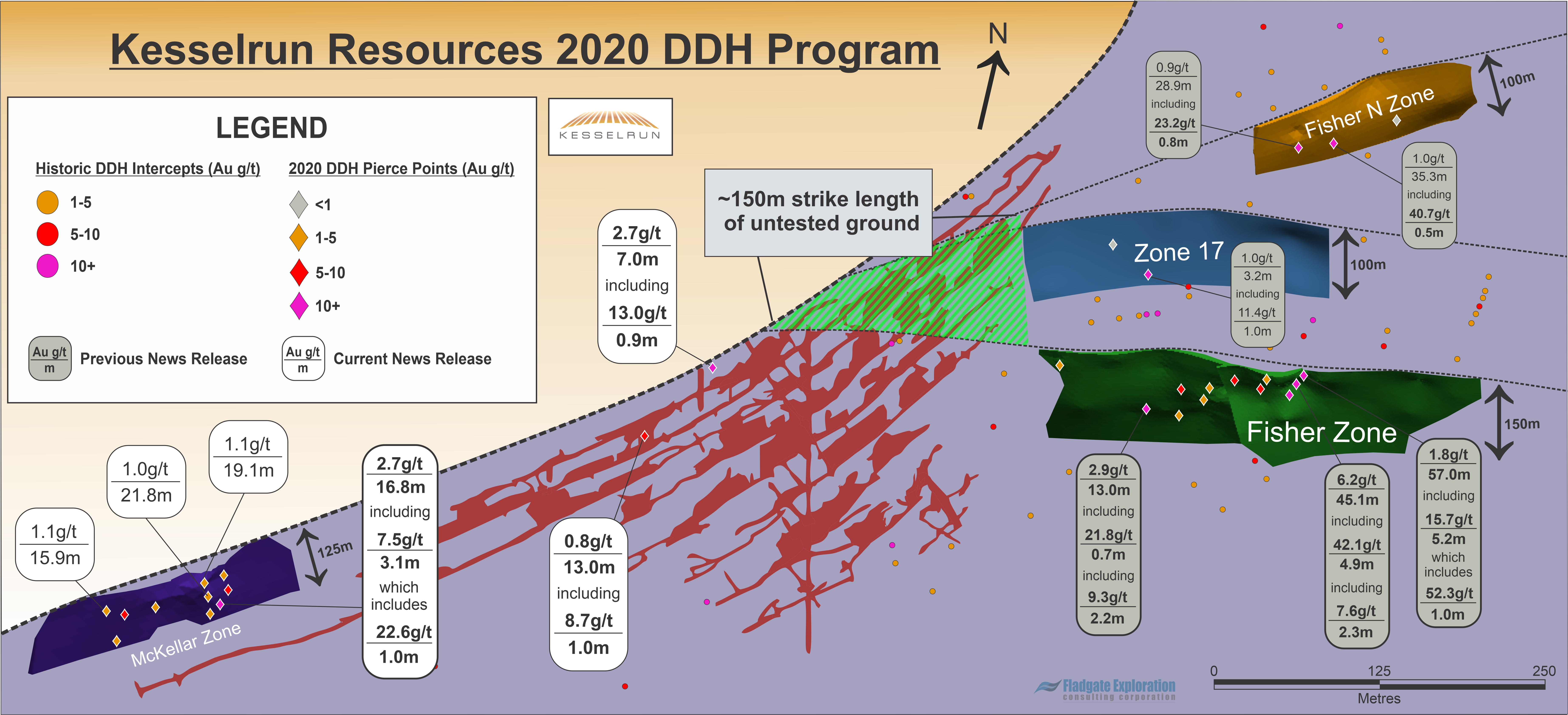

Figure 1: Schematic Block Section – Huronian Project

Michael Thompson, P.Geo., President and CEO of the Company, commented, “Our drilling on the McKellar Zone is the first step in our plan to extend mineralization down dip and along the more than two kilometres of strike length to the southwest. To the northeast of the McKellar zone lies the Huronian Zone where historic mining was focused on the narrow high-grade quartz veins which are hosted within a wide mineralized shear zone. We believe there is enormous potential to outline remnant mineralization amongst the historic workings as well as down dip and north east strike extents”.

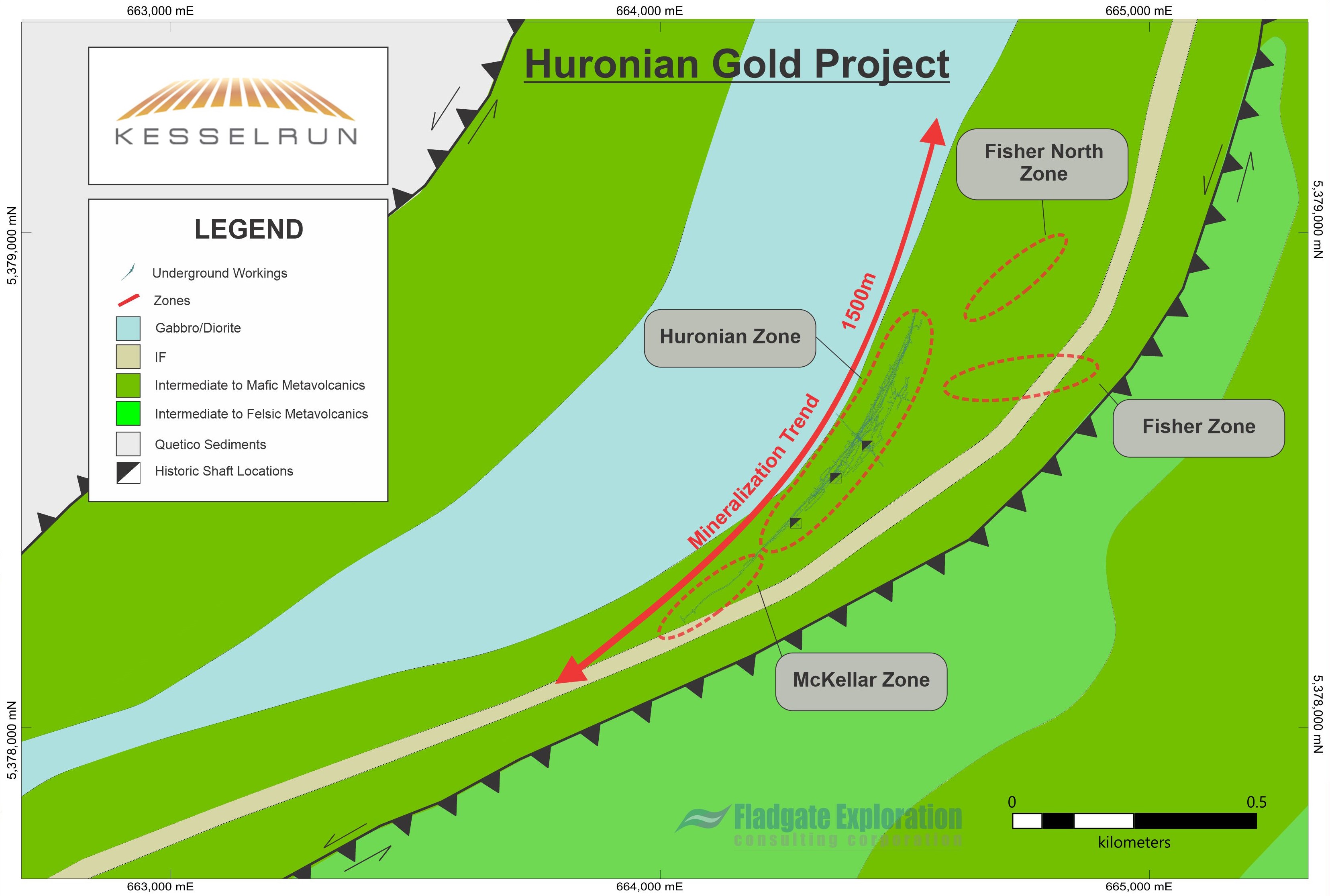

The 2020 Huronian drill program targeted four zones; Fisher, Fisher North, McKellar and Huronian. The four zones are in close proximity along an approximate 1500 m strike length in the area of the historic Huronian Mine. The zones include multiple generations of quartz veins that carry high grade gold values in association with altered, sheared and variably mineralized mafic volcanics, feldspar-quartz porphyries and iron formation.

Previous operators have focused on the Fisher, Fisher North and McKellar Zones where drilling has been concentrated at near surface depths of 75 metres or less, while the Huronian Zone has been mostly unexplored since the closure of the mine in 1936. As a result, Kesselrun believes there to be significant upside potential on all zones.

Figure 2: Schematic Plan Map – Huronian Project

Table 1: Summary of Significant Drill Intercepts – Huronian Project – McKellar & Huronian Zones (1)

| Hole ID | From (m) | To (m) | Interval (m) | Au (g/t) | Zone |

|---|---|---|---|---|---|

| 20HUR018 | 44.2 | 56.2 | 12.0 | 1.0 | McKellar |

| including | 44.2 | 50.0 | 5.8 | 2.0 | |

| 20HUR019 | 43.0 | 58.0 | 15.0 | 0.8 | McKellar |

| 20HUR020 | 35.9 | 55.0 | 19.1 | 1.1 | McKellar |

| including | 35.9 | 37.8 | 1.9 | 3.1 | |

| including | 46.5 | 48.6 | 2.1 | 3.1 | |

| 20HUR021 | 39.4 | 61.2 | 21.8 | 1.0 | McKellar |

| 20HUR022 | 42.5 | 61.1 | 18.6 | 0.6 | McKellar |

| including | 46.0 | 57.7 | 11.7 | 0.8 | |

| which includes | 46.0 | 54.5 | 8.5 | 0.9 | |

| 20HUR023 | 18.7 | 57.5 | 38.8 | 0.5 | McKellar |

| including | 37.7 | 57.5 | 19.8 | 0.7 | |

| which includes | 41.6 | 57.5 | 15.9 | 1.1 | |

| which includes | 44.0 | 57.5 | 13.5 | 1.2 | |

| 20HUR024 | 81.4 | 91.5 | 10.1 | 0.9 | McKellar |

| including | 81.4 | 89.9 | 8.5 | 1.0 | |

| 20HUR025 | 31.3 | 48.1 | 16.8 | 2.7 | McKellar |

| including | 31.3 | 39.4 | 8.1 | 2.6 | |

| which includes | 31.3 | 36.4 | 5.1 | 3.9 | |

| which includes | 31.3 | 33.0 | 1.7 | 10.2 | |

| which includes | 31.3 | 32.3 | 1.0 | 16.8 | |

| and including | 44.1 | 48.1 | 4.0 | 5.9 | |

| which includes | 45.0 | 48.1 | 3.1 | 7.5 | |

| which includes | 46.0 | 48.1 | 2.1 | 10.9 | |

| which includes | 46.0 | 47.0 | 1.0 | 22.6 | |

| 20HUR026 | 29.8 | 45.8 | 16.0 | 0.5 | McKellar |

| including | 42.2 | 43.0 | 0.8 | 2.3 | |

| 20HUR027 | 9.9 | 33.7 | 23.8 | 0.5 | McKellar |

| including | 9.9 | 11.0 | 1.1 | 6.9 | |

| 20HUR028 | 7.3 | 13.4 | 6.1 | 0.6 | New |

| including | 9.6 | 13.4 | 3.8 | 0.7 | |

| which includes | 10.4 | 13.4 | 3.0 | 0.9 | |

| and | 70.0 | 83.0 | 13.0 | 0.8 | Huronian HW |

| including | 78.0 | 83.0 | 5.0 | 2.1 | |

| which includes | 81.2 | 83.0 | 1.8 | 5.2 | |

| which includes | 82.0 | 83.0 | 1.0 | 8.7 | |

| 20HUR029 | 29.0 | 36.0 | 7.0 | 2.7 | Huronian |

| including | 29.0 | 29.8 | 0.8 | 7.1 | |

| and including | 34.3 | 36.0 | 1.7 | 7.5 | |

| which includes | 35.1 | 36.0 | 0.9 | 13.0 |

(1)Widths are drill indicated core length as insufficient drilling has been undertaken to determine true widths at this time. Average grades are calculated with un-capped gold assays as insufficient drilling has been completed to determine capping levels for higher grade gold intercepts.

Update on Brokered Private Placement

The Company is also pleased to announce that it has been notified by Red Cloud Securities that the brokered financing announced on November 16, 2020, upsized from up to $3.0 million to up to $5.0 million, has been fully subscribed and allocated. The Company will notify the market when the financing has closed.

About the Huronian Gold Project

The 100% owned Huronian Gold Project hosts the past producing Huronian Mine, Northwestern Ontario’s first gold mine with an historic resource estimate of 44,592 oz Au @ 15.3 g/t Au in the indicated category and 501,377 oz Au @ 14.4 g/t Au in the inferred category. The resource estimate presented for the Huronian Project is historic in nature. Kesselrun Resources’ qualified person has not completed sufficient work to confirm the results of the historical resource. Kesselrun Resources is not treating this as a current mineral resource but is considering it relevant as a guide to future exploration and is included for reference purposes only. The historic resource was estimated by Minescape Exploration Inc. in 1998. Further drilling will be required by Kesselrun Resources to verify the historic estimate as current mineral resources.

As well, the Huronian Gold Project hosts the same lithological package of rocks, as interpreted from both Government of Ontario and Kesselrun Resources mapping, compilation and modelling, on strike from Wesdome Gold’s (TSX:WDO) adjacent Moss Lake Gold Deposit with a resource estimate of 1,377,300 oz Au @ 1.1 g/t Au in the indicated category and 1,751,600 oz Au @ 1.1 g/t Au in the inferred category as outlined in their 2013 PEA2. Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Kesselrun Resources’ property.

(2)Moss Lake Gold Mines (currently wholly owned subsidiary of Wesdome Gold) news releases February 20, 2013 and September 9, 2013.

Qualified Person

Michael Thompson, P.Geo., President and CEO of Kesselrun, is the Qualified Person responsible for the project as defined by National Instrument 43-101 and has approved the technical information in this news release.

QAQC

Kesselrun has implemented a quality control program to comply with industry best practices for sampling, chain of custody and analyses. Certified gold reference standards, blanks and duplicates are inserted at the core processing site as part of the QA/QC program in addition to the control samples inserted by the lab. Samples are prepared and analyzed by Activation Laboratories in Thunder Bay. Samples are analyzed for gold using Fire Assay-AA techniques. Samples returning over 10 g/t gold are analyzed using Fire Assay-Gravimetric methods. Selected samples are also analyzed with a standard 1 kg metallic screen fire assay. All results reported herein have passed QA/QC protocols.

Health and Safety

The health and safety of our personnel and contractors is always top priority to Kesselrun. The current situation presents new challenges above and beyond what we normally face while working in the field. Kesselrun has implemented further measures to ensure the health and safety of all working on the Company’s projects.

About Kesselrun Resources Ltd.

Kesselrun Resources is a Thunder Bay, Ontario-based mineral exploration company focused on growth through property acquisitions and discoveries. Kesselrun's management team possesses strong geological and exploration expertise in Northwest Ontario. For more information about Kesselrun Resources, please visit www.kesselrunresources.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

For additional information please contact:

Kesselrun Resources Ltd.

Michael Thompson, P.Geo., President & CEO

807.285.3323

michaelt@kesselrunresources.com

Corporate Communications

1.866.416.7941 information@kesselrunresources.com

Forward Looking Statements – Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of Kesselrun, including, but not limited to the impact of general economic conditions, industry conditions, volatility of commodity prices, dependence upon regulatory approvals, the execution of definitive documentation, the availability of financing and exploration risk. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements.